“Spring” into Action

“For behold, the winter is past; the rain is over and gone. The flowers appear on the earth, the time of singing has come, and the voice of the turtledove is heard in our land.” Song of Solomon

Spring has come. Yes! I love the spring. A time to get back out and enjoy sunshine, growth and adventure. When I think of adventure, one man that comes to mind is, Bear Grylls.

“Bear” is a British adventurer who became a TV personality. He brings survival and adventure to life. He became a popular figure in his show “Man vs. Wild”. He is down to earth and an adventurer at his core. In one of his shows, “YOU VS. WILD”, he puts critical decision making on the viewer. Our boys love this. Bear navigates tricky terrain, comes to a spot and then asks the viewer to make a decision on which course to take. He lays out danger, strategy and potential outcomes for each path that could be potentially taken. The viewer must then select which choice to make. Bear then carries forward the video for the path that was selected and shows whether or not the viewer chose correctly.

With investment management, there are several different ways to accumulate wealth overtime. Stocks, Bonds, Real Estate and other assets have all appreciated over time. Each of these carries different risk profiles with distinct reward profiles as well.

Given the nature of severe selling of stocks and bonds in 2022, and high available returns on money market funds, 2023 started out with a great deal of opportunity in various asset classes in my opinion. So which investment category is best to go with? How do I select which “path” to take?

In Bear Grylls case, one mistake in survival can cost you your life. Similarly, while investing in turbulent uncertain times, it can feel like you’ve lost your financial life. It’s gotten away from you. How can this happen. I can’t take it anymore. Sound familiar? Fortunately and different from a survival situation, asset classes (stocks, bonds, real estate) have always recovered and have started new cycles. The rain seems to subside and you are feeling a bit more like spring emotionally.

If I were to make an investment comparison with a survival situation, it would go something like this: When embarking into investment management adventure, it is important to have the proper gear. (resources, expertise, analysts, historical data, non-emotional attachments and good product). Next, you want to scope the terrain you will potentially encounter. (current events, state of global economies, geopolitical risks, inflation, interest rates). Lastly, determine the best way to navigate the risky paths to choose from. (mitigate risk) This is done by taking all these things into consideration and assembling various asset allocations (how much in stocks, bonds, money markets etc) correlated to the adventurer’s (investors) risk profile. For example, there are certain hikes our young boys go on that they can easily handle while others are far too risky. They still do a hike and enjoy the experience, but, do not have the potential “drops” that a more experienced hiker is willing to take on.

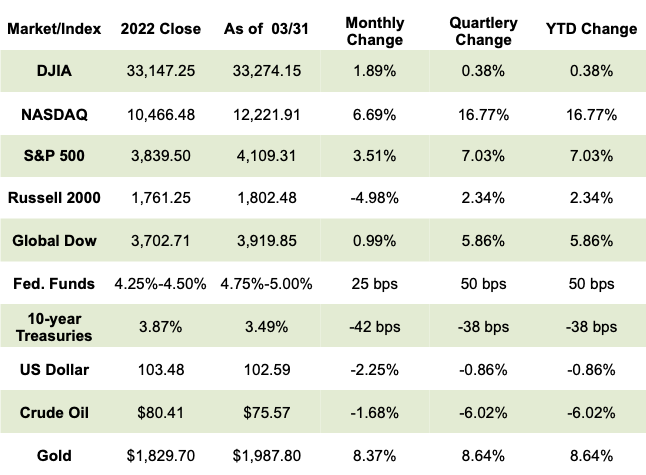

With all this in mind, these are exciting times to be an investor. It’s a new environment with interest rates being high. This creates opportunities in other asset classes (like bonds) that could potentially create great returns without taking on as much risk. Every day, week, month and year in the markets presents different challenges and opportunities. I’m grateful to serve so many wonderful clients to help navigate whatever waters we come across. With that, here are some 1st quarter numbers!

Positive Quote:

"You are never too old to set another goal or to dream a new dream.”

- C.S. Lewis

Fun Fact:

In 2020 and 2021, my wife, our 3 boys and I traveled the country in our 5th wheel trailer for a year. We spent time in 19 states!

The Markets

First Quarter through March 31, 2023

Wall Street proved resilient during the first quarter of the year, despite rising inflation, uncertainty about the Federal Reserve's actions, interest-rate hikes, and banking concerns. Inflationary data in January seemed to show inflation may have peaked, and the Fed would scale back its interest-rate hikes, if not cut them. However, subsequent inflation data showed prices ramped up again. Stocks and bond prices dipped as investors responded to concerns that interest rates would continue to rise and for a longer period of time. In addition to the impact of rising inflation, two major banks collapsed in March, sending bank stocks lower. Credit Suisse Group, nearing failure, was taken over by rival UBS Group, while several U.S. banks provided funds to keep First Republic Bank afloat. The economic recession that has been predicted has yet to come to fruition. The labor market remained strong, and while inflation continued to rise, the two primary indicators, the Consumer Price Index and the Personal Consumption Expenditures Price Index, showed prices slowed on an annual basis.

Despite all of this apparent turmoil, coupled with the ongoing war in Ukraine, stocks regained their footing and ended the quarter on the plus side. The tech-heavy Nasdaq led the benchmark indexes, followed by the S&P 500, the Global Dow, the Russell 2000, and the Dow. Investors poured money back into Mega cap Tech shares, driving them higher during the first quarter of 2023 after an underperforming 2022. Those gains helped drive the Nasdaq and the S&P 500 higher. Even with investors taking some gains from the Mega caps, other market sectors reaped the benefits. Energy stocks, which excelled in 2022, fell in the first quarter of 2023, as did crude oil prices. Gas prices rose minimally higher, with regular retail prices averaging $3.421 per gallon on March 27, $0.14 over prices on January 4. The dollar dipped lower, while gold prices rose higher.

The quarter kicked off with stocks enjoying their best January performance since 2019, as inflation data suggested that inflation may have peaked, raising hopes that the Federal Reserve would scale back interest-rate hikes and temper fears of an economic recession. Nevertheless, Federal Reserve Chair Jerome Powell cautioned that the battle against rising inflation was far from over and additional rate hikes were upcoming. In fact, the Federal Reserve hiked interest rates 25.0 basis points on the last day of the month. Growth stocks performed best, with Mega caps making solid gains. Consumer discretionary, communication, and tech sectors performed well, while defensive sectors, such as utilities, health care, and consumer staples, dipped lower. Bond prices advanced, pulling yields lower. While 260,000 new jobs were added in December, the growth was the slowest in two years. Average hourly earnings rose to the lowest annual level (4.6%) since September 2021. However, manufacturing declined at the fastest rate since May 2020, while services retracted for the third month running, according to the S&P Global Manufacturing PMI™. Nevertheless, each of the benchmark indexes listed here added value, led by the Nasdaq (10.7%), followed by the Russell 2000 (9.7%), the Global Dow (7.8%), the S&P 500 (6.2%), and the Dow (2.8%). Ten-year Treasury yields fell 35.0 basis points, crude oil prices dipped 1.7%, the dollar slid 1.4%, but gold prices advanced 6.3%.

Stocks gave up some of their January gains in February, with each of the benchmark indexes losing value. The Dow (-4.2%) fell the furthest, followed by the Global Dow (-2.7%), the S&P 500 (-2.6%), the Russell 2000 (1.8%), and the Nasdaq (-1.1%). Bond prices declined, driving yields higher, with 10-year Treasury yields advancing 39 basis points. Crude oil prices decreased 2.8% to $76.86 per barrel. The dollar rose 2.8% against a basket of currencies. Gold prices lost most of their January gains, falling 5.7% in February. Consumer prices advanced, with core prices (excluding food and energy prices) climbing 0.6%, the biggest advance since August. Over 500,000 new jobs were added, nearly three times the consensus estimates, and the largest increase in six months. The unemployment rate slid to 3.4%, its lowest level since 1969. Consumer spending rose 1.8%, the most in nearly two years.

March was a very choppy month for market returns. Despite an apparent banking crisis, investors stayed the course for the most part, driving stocks mostly higher. The Nasdaq and the S&P 500 led the gainers of the benchmark indexes listed here. Several sectors outperformed, including information technology, communication services, and utilities, while financials fell notably on the heels of the aforementioned bank failures. Manufacturing retracted, while services advanced, according to purchasing managers surveyed. Labor remained strong, with 311,000 new jobs added. Hourly earnings rose by $0.08 for the month and 4.6% since February 2022. The Consumer Price Index rose 0.4% after falling 0.5% the previous month. The PCE price index increased 0.3% and 5.0% over the past 12 months. The economy advanced at an annualized rate of 2.6% in the fourth quarter, short of the 3.2% increase in the third quarter. Crude oil prices and the dollar declined, while gold prices climbed higher.

Eye on the Month Ahead

The second quarter is likely to see interest rates continue to be pushed higher by the Federal Reserve. However, rate hikes may be smaller, with the possibility of a reduction in the number of increases. The labor sector should remain solid, although job gains may wane some. Industrial production may actually show some gains, while the services sector is more likely to strengthen.

Data sources: Contribution provided by Forefield. Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e. wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. The U.S. Dollar Index is a geometrically weighted index of the value of the U.S. dollar relative to six foreign currencies. Market indices listed are unmanaged and are not available for direct investment.

I look forward to continuing to guide clients through 2023 and beyond. If you have a friend or family member that you think would benefit from working with me, please don’t hesitate to make the introduction. Thank you for your trust and business.